Condo Insurance in and around Severna Park

Condo unitowners of Severna Park, State Farm has you covered.

Condo insurance that helps you check all the boxes

- Severna Park

- Arnold

- Millersville

- Gambrills

- Odenton

- Crofton

- Glen Burnie

- Columbia

- Brooklyn

- Baltimore

- Essex

- Woodbine

- Anne Arundle County

- Baltimore County

- Howard County

- Baltimore City

- District of Columbia

Calling All Condo Unitowners!

There are plenty of choices for condo unitowners insurance in Severna Park. Sorting through coverage options and deductibles can be overwhelming. But if you want surprisingly great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Severna Park enjoy unbelievable value and straightforward service by working with State Farm Agent Jeffrey Brent. That’s because Jeffrey Brent can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as sports equipment, jewelry, electronics, videogame systems, and more!

Condo unitowners of Severna Park, State Farm has you covered.

Condo insurance that helps you check all the boxes

Put Those Worries To Rest

When a windstorm, an ice storm or theft cause unexpected damage to your condominium or someone is injured because of negligence on your part, having the right coverage is significant. That's why State Farm offers such great condo unitowners insurance.

As a reliable provider of condo unitowners insurance in Severna Park, MD, State Farm aims to keep your belongings protected. Call State Farm agent Jeffrey Brent today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Jeffrey at (410) 544-7174 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Jeffrey Brent

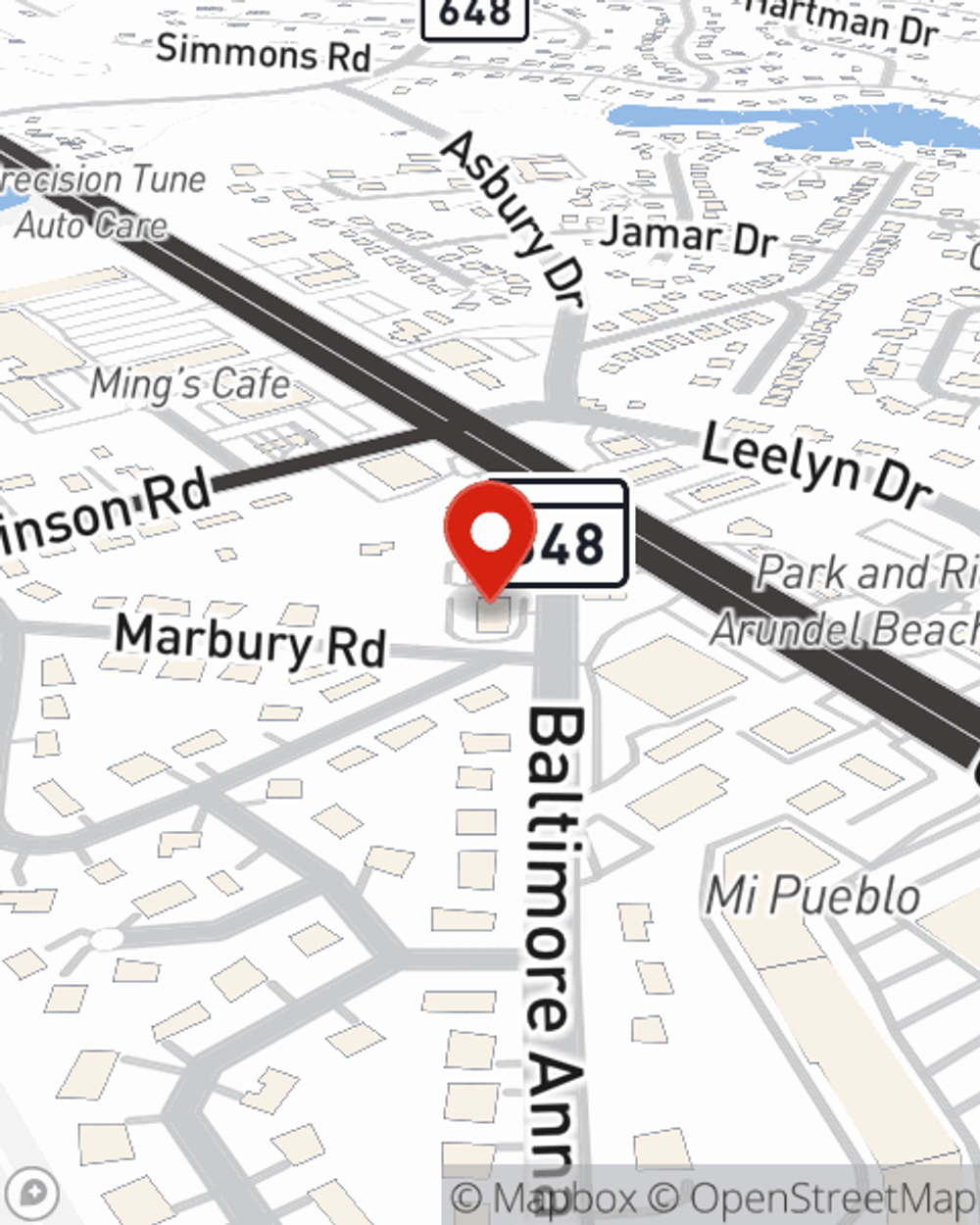

State Farm® Insurance AgentOffice Address:

Suite #7

Severna Park, MD 21146-3890

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.